The antibody drug conjugates (ADCs) market has been gaining momentum, with an estimated value of USD 7.96 billion in 2023. It’s projected to grow at a significant CAGR of 17.1% through 2032, reaching USD 32.97 billion. ADCs are powerful cancer treatments that combine the specificity of monoclonal antibodies with the potency of cytotoxic drugs. This combination allows ADCs to target and kill cancer cells more precisely than traditional chemotherapy, reducing collateral damage to healthy cells. ADCs’ growing recognition as a major advancement in targeted cancer therapy is driven by recent technological advances, increasing R&D investments, and rising cancer prevalence globally.

1. Key Market Drivers

a. Rising Prevalence of Cancer

Cancer remains one of the leading causes of death worldwide, with more than 10 million new cases reported annually. ADCs’ ability to target cancer cells with precision has established them as an important innovation in oncology. As cancer rates continue to climb, the demand for effective and minimally invasive treatments like ADCs is increasing, prompting pharmaceutical companies to invest in R&D.

b. Technological Innovations in ADC Design

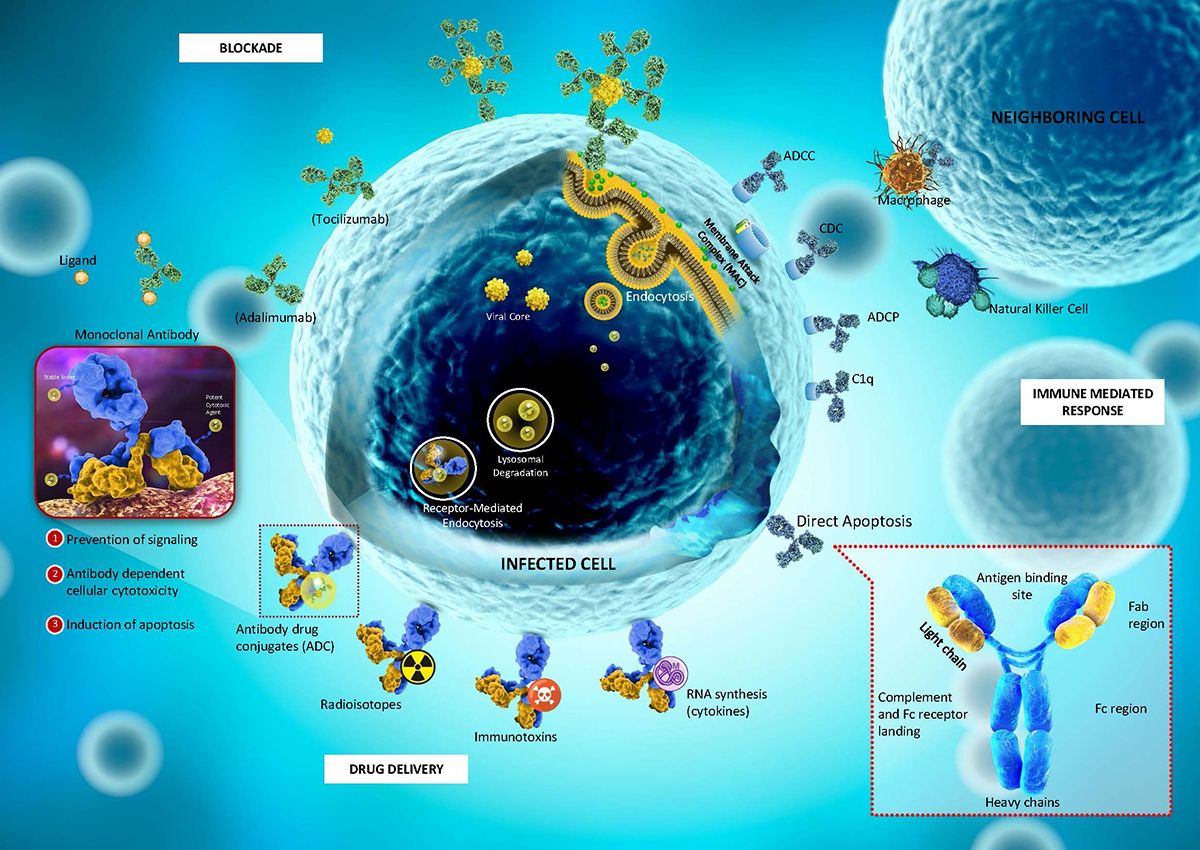

Recent advancements in ADC technology are revolutionizing the way these therapies are designed. Key innovations include:

- Enhanced Linker Technologies: Linkers connect the antibody to the cytotoxic agent, releasing it when it reaches the target cell. Improved linkers, such as non-cleavable and enzymatically cleavable linkers, are more stable, which helps prevent premature drug release and reduces side effects.

- Improved Payloads: Cytotoxic agents have become more potent, requiring only a small amount to kill target cells. Novel payloads, such as auristatins and maytansinoids, are currently in development, further enhancing ADC efficacy.

- Site-Specific Conjugation: This technology allows for precise drug attachment sites, leading to more uniform ADCs, which improve both stability and safety profiles.

c. Government and Private Sector Funding

Growing recognition of ADCs’ therapeutic potential has spurred government agencies and private investors to fund research and clinical trials, expediting their journey to market. Countries like the United States are providing grants for ADC R&D, with organizations such as the National Institutes of Health (NIH) playing a significant role. Private venture capital has also poured billions into ADC-focused biotech firms, reflecting strong investor confidence in the market’s future.

2. Competitor Landscape and Key Players

Leading companies in the ADC market have recognized the value of collaborations and partnerships to accelerate their research and bring new ADCs to market faster. The top players include:

- Seagen Inc.: A pioneer in ADC technology, known for Adcetris, a groundbreaking treatment for Hodgkin lymphoma.

- ImmunoGen Inc.: Specializes in ADC development, with a focus on expanding beyond oncology.

- Pfizer Inc.: A pharmaceutical leader that has recently increased its ADC capabilities through acquisitions and collaborations.

- AbbVie Inc. and AstraZeneca PLC: Both are heavily investing in oncology-focused ADCs, advancing their clinical pipelines through collaborations and internal research.

Strategic Collaborations

These companies are increasingly engaging in partnerships to enhance their R&D capabilities and resource-sharing. For example:

- Pfizer and Mersana Therapeutics: Collaborated to develop a new ADC platform aimed at improving delivery and precision.

- Takeda and Seagen Inc.: Partnered to co-develop ADC products, combining Seagen’s proprietary technology with Takeda’s extensive R&D resources.

- Oxford BioTherapeutics Ltd and Sorrento Therapeutics Inc.: Formed a strategic alliance to leverage Oxford’s ADC platform with Sorrento’s immunotherapy expertise.

These partnerships are instrumental in pushing ADC innovations forward, facilitating faster product development and market entry.

3. Key Features of the Market Report

The market report provides in-depth analyses on various factors shaping the ADC market:

a. Patent Analysis

Patent filings are a critical factor in the ADC market, providing insights into where innovation is heading. For instance, leading companies like Roche and AstraZeneca have filed numerous patents around new linker technologies and novel payloads, indicating where they are focusing their R&D.

b. Grants Analysis

Government grants are vital for advancing ADC research, especially in early-stage development. For example, the NIH and European Commission have recently funded multiple projects focused on improving ADC safety and expanding their applications.

c. Clinical Trials Analysis

With over 300 active clinical trials worldwide, the ADC market is vibrant and competitive. Phase III trials have shown promising results in expanding ADC use to different types of cancer and even some non-cancerous conditions.

d. Funding and Investment Analysis

Venture capital has a strong presence in ADC funding. Major players like Pfizer Ventures and Amgen Ventures are actively investing in ADC startups, looking to enhance their oncology portfolios.

e. Partnerships and Collaborations Analysis

Collaborations between biotech firms, academic institutions, and big pharma have been increasing. For instance, AstraZeneca and Daiichi Sankyo have been jointly developing ADCs, pooling resources for a more rapid and cost-effective development process.

4. Regional Analysis

- North America:

The largest regional market, accounting for nearly 50% of global ADC revenue, thanks to advanced healthcare infrastructure, strong funding, and regulatory support. - Europe:

Europe is the second-largest market, driven by high healthcare expenditures and supportive policies from entities like the European Medicines Agency (EMA). The UK and Germany are among the top contributors to the market. - Asia-Pacific:

This region is expected to witness the fastest growth, fueled by rising cancer incidence, improving healthcare infrastructure, and increased R&D spending, especially in Japan, China, and South Korea. - Rest of the World:

The Latin American and Middle Eastern markets are in the early stages but are witnessing increased interest due to healthcare improvements and government initiatives.

5. Market Segmentation and Emerging Trends

- By Application:

- Oncology remains the dominant application area, but there is potential for expansion into other therapeutic areas, such as autoimmune diseases and infectious diseases.

- By Component:

- ADCs are composed of antibodies, linkers, and payloads. Innovations in each component are pushing the boundaries of ADC effectiveness and safety.

- By Technology:

- Site-specific conjugation and improved linker technologies are among the most prominent trends, driving next-generation ADCs that are more stable and precise.

- Emerging Trends:

- Beyond Cancer Applications: With new research, there is potential to apply ADCs to diseases like autoimmune disorders and infectious diseases.

- Regulatory Pathways: Agencies like the FDA are creating faster regulatory pathways for ADC approvals, recognizing their potential in addressing unmet medical needs.